Budgeting can be difficult, particularly for freelancers who have inconsistent income. Cash flow and expenses which need to be managed well. Yajie shares some tips around how freelancers can navigate this challenge, including managing variable income and wholesale budget planning strategies.

Tips for Managing Variable Income

Freelancers are accustomed to dealing with inconsistent income, and it is difficult to predict how much money will be coming in each month. To address this, it's imperative to work from a budget constructed using your average monthly income. Begin by monitoring additional income over several months to identify your base monthly income. Now that you have a sense of this, make a budget that accounts for your basic costs (rent, utilities, groceries). Stash a portion of your earnings for taxes and savings to help make sure you can cover unforeseen costs or lean months. Also, try to spread out your income and not put all of your eggs in one basket. In this post, we’re going to share some tips on how freelancers can stores up their variable income for financial stability.

Freelancer Wholesale Budget Planning Techniques

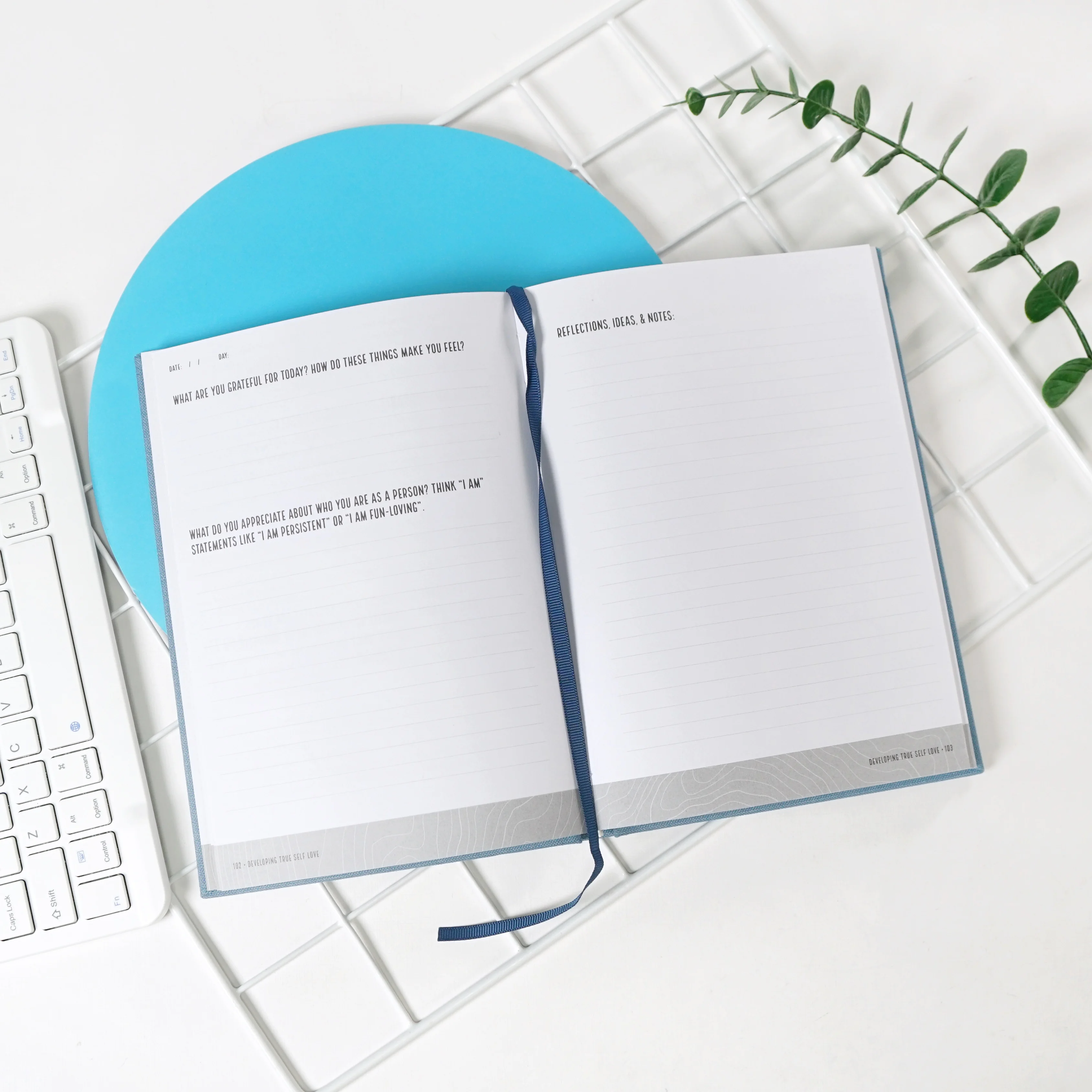

When it comes too wholesale budgeting, freelancers need to consider the special challenges that come with bulk purchasing. You don’t want to buy a whole load of equipment only to find out there’s cheaper suppliers out there. Plan a budget for wholesale orders using budget notebook, including not only the price per item but also minimums and shipping. Find and approach suppliers about discounts and better prices for bulk orders. It is also important to consider storage and inventory expenses before considering wholesale purchases. I’m sure the freelancers can think of better ways to spend potential Photoshop money. Carefully planning and budgeting for wholesale purchases. Coincidentally, this last point is one that is addressed in a real world example outlined below.

Budgeting as a freelancer can be a bit of a challenge because you have uneven income and cash flow. And you must have a strategy to be sure you can cover your expenses and save for the future. The following are advice and tools to help you budget and plan as a freelancer.

Where to Look for Freelancer Budget Planning Resources

Online financial sites and blogs are one of the better sources for freelancer budget planner. Websites like Yajie contain a trove of information about budgeting, saving and handling your finances as a freelancer. You can also get useful tips and advice from other freelancers who have been in your shoes as well.

There are also a lot of financial books and podcasts out there. Trying to learn how to manage your finances as a freelancer? Freelance budget planning placeholder best freelancer tools for budgeting.

And when it comes to budgeting as a freelancer, the tools you have at your disposal can make a big impact. There are no shortage of budgeting apps and software out there to help you track your income, expenses, and savings goal. Some popular budgeting tools for freelancers are YNAB (You Need a Budget), Mint and Quick Books Self-Employed.

These journal planner tools let you input your income and expenses, establish savings goals and monitor your progress over time. You can also add your own budget categories that are tailored for a freelancer’s adjusted financial lifestyle. Utilize these resources frequently so you can prioritize your finances and make smart determinations about how you spend or save money.

Crafting a Freelance Budget

Freelancing budgeting includes your steady income, all fixed and variable expenses, and savings goals. Begin by determining your average monthly income from freelancing and any other income sources you have. Then, write down your fixed expenses: like rent, utilities and insurance.

Then, list out your variable expenses: that includes things like groceries, transportation or entertainment. These are variable costs, so you'll want to monitor them closely and reallocate your budget accordingly. And then put some of the money in that savings account away for a rainy day and later on, retirement.

With these steps and the proper resources and tools you can manage your freelance budget effectively in order to meet your monetary ambitions. Be sure to revisit your budget periodically and make changes as necessary to ensure that you’re on the right track toward achieving financial stability tomorrow.